Table of Contents

- The 3 Best REITs to Buy in May 2024

- Not all REITs are created equal. Here's the best REITs for 2024!

- REITs Report Card 2023: How Singapore REITs Performed In FY2023

- 10 Of The Best REITs To Buy For 2024 | Seeking Alpha

- Top Real Estate Investment Trends to Watch in 2025 - Luxury Residences ...

- The Future of Real Estate Investment in 2025

- Where do REITs fit in a portfolio? (2025)

- REITs: Late 2023 Performance Suggests Brighter Outlook for an Evolving ...

- Unlocking Value For Investors

- Best 10 REITs performance in Malaysia 2023

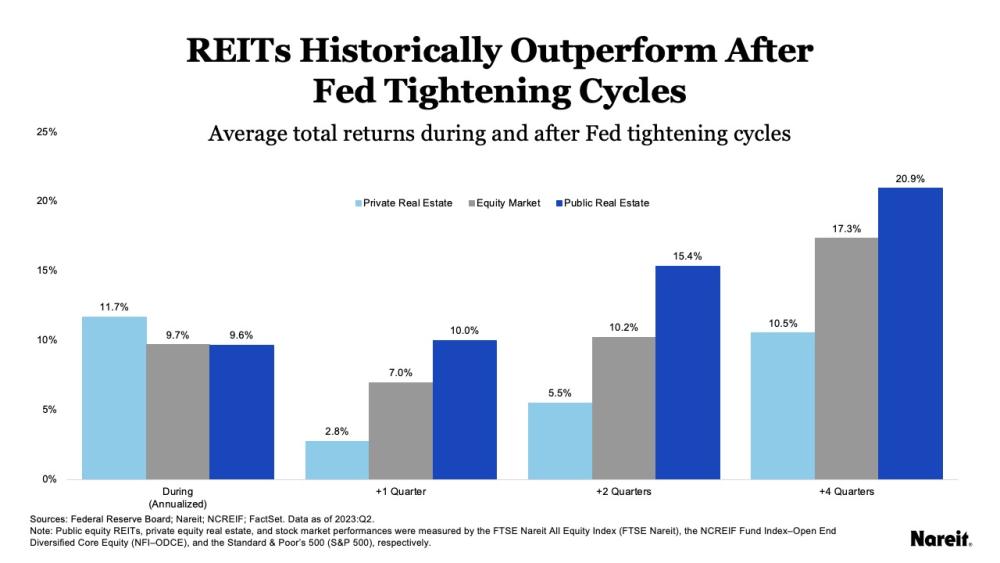

REITs offer a unique way to invest in real estate without directly owning physical properties. By pooling funds from multiple investors, REITs can acquire and manage a diverse portfolio of properties, providing a steady stream of income through rental payments and property sales. With interest rates expected to remain low in 2025, REITs are poised to continue their strong performance, making them an attractive option for income-seeking investors.

Top 10 REITs for 2025

- Realty Income (O): Known for its diversified portfolio of commercial properties, Realty Income has a strong track record of delivering consistent dividend payments.

- National Retail Properties (NNN): With a focus on retail properties, National Retail Properties has demonstrated resilience in the face of changing consumer trends.

- Simon Property Group (SPG): As one of the largest shopping mall operators in the US, Simon Property Group has a significant presence in the retail sector.

- Welltower (WELL): Specializing in healthcare-related properties, Welltower is well-positioned to capitalize on the growing demand for senior housing and medical facilities.

- Ventas (VTR): With a diverse portfolio of healthcare and senior housing properties, Ventas has established itself as a leader in the REIT sector.

- Equity Residential (EQR): Focusing on apartment properties, Equity Residential has a strong presence in urban markets across the US.

- AvalonBay Communities (AVB): As a leading developer and operator of apartment properties, AvalonBay Communities has a reputation for delivering high-quality living spaces.

- Mid-America Apartment Communities (MAA): With a portfolio of apartment properties across the US, Mid-America Apartment Communities has a strong track record of growth and dividend payments.

- Essex Property Trust (ESS): Specializing in apartment properties on the West Coast, Essex Property Trust has a significant presence in high-growth markets.

- Healthcare Realty Trust (HR): Focusing on healthcare-related properties, Healthcare Realty Trust has established itself as a leader in the medical office and senior housing sectors.

Investment Strategy for 2025

In conclusion, the top 10 REITs identified by Seeking Alpha offer a range of investment opportunities for those seeking dividend income and exposure to the real estate market. By considering these REITs and developing a well-thought-out investment strategy, you can position yourself for success in 2025 and beyond.

Remember to always conduct your own research and consult with a financial advisor before making any investment decisions. With the right approach, REITs can be a valuable addition to your investment portfolio, providing a steady stream of income and potential long-term growth.